What good things could Penn State do with an extra $2.3 billion in the endowment?

A perpetual 10% reduction of in-state tuition would be a good start.

When I ran for Penn State trustee, I wrote How I will fix Penn State. The first remedy I proposed to help correct the University’s financial problems was: Proper management of the Penn State endowment, with sufficient savings to reduce tuition costs by at least 10%.

Now that the Commonwealth of Pennsylvania has declined to increase state funding and Penn State is operating with a large operating budget deficit, generating more operating income is a priority. Let’s take a close look at the endowment.

Like many universities, oversight of the endowment is the responsibility of the Board of Trustees. Their job is to maximize the benefit of Penn State’s $4.5 billion endowment, which is then used to fund scholarships, faculty positions, mission-critical initiatives, and donor-directed projects. The Board delegates many of those responsibilities to the Penn State Investment Council (PSIC) and the University’s Office of Investment Management (OIM), managed by Senior Vice President for Finance & Business Sara Thorndike.

The PSIC is composed of 14 members, including trustees Matthew Schuyler and Mary Lee Schneider, and at-large members Brandon Short, Barbara Doran, and Randall Black. They approve the investment managers who are paid administrative fees to invest the endowment funds. Per the PSIC policy statement, they must meet at least once a year and report to the full Board of Trustees. This annual report is a broad-brush overview with little detail or contextual information (see Note 1). In addition, their policy states (page 5) “PSIC meetings are not subject to Open Meeting Laws and are only open to PSIC members and invited guests.”

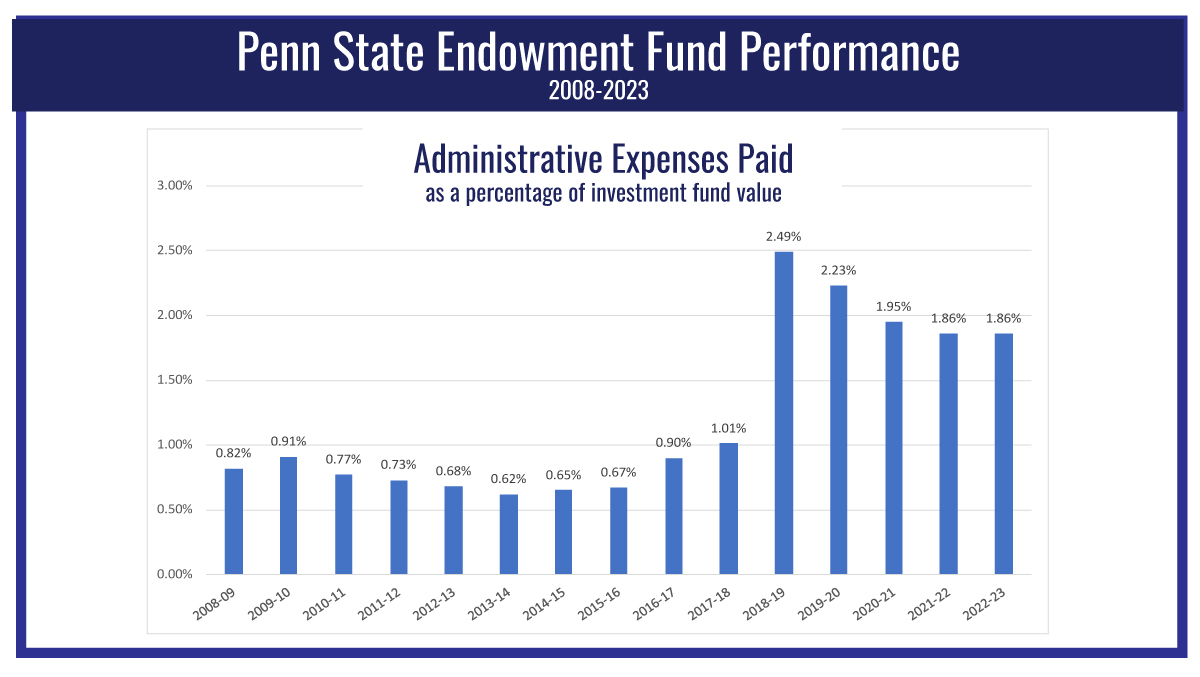

Until recently, the PSIC website included a policy stating that endowment administrative expenses should be limited to no more than 75 basis points per year, which means 0.75% of the amount being invested. The industry considers this a reasonable limit, and prior to 2016 Penn State’s administrative expenses averaged 0.73% (73 basis points) per year, just under the guideline maximum. Those expenses, as reported on Penn State’s IRS Form 990, began to rise dramatically in 2017, more than tripling within three years (see Note 2).

Unfortunately, these higher expenses did not yield stronger performance.

A way to judge a fund manager’s performance is to compare their long-term earnings to the Standard and Poor’s 500 Index. This shows effect of the strategic decisions made by the manager, specific selections made by the investment group, and the ability to control expenses versus market performance.

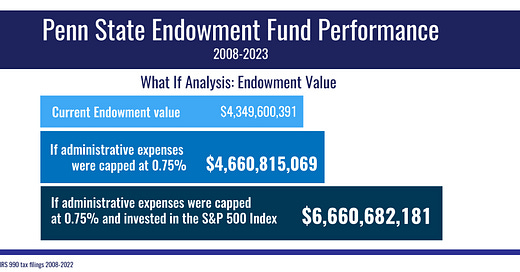

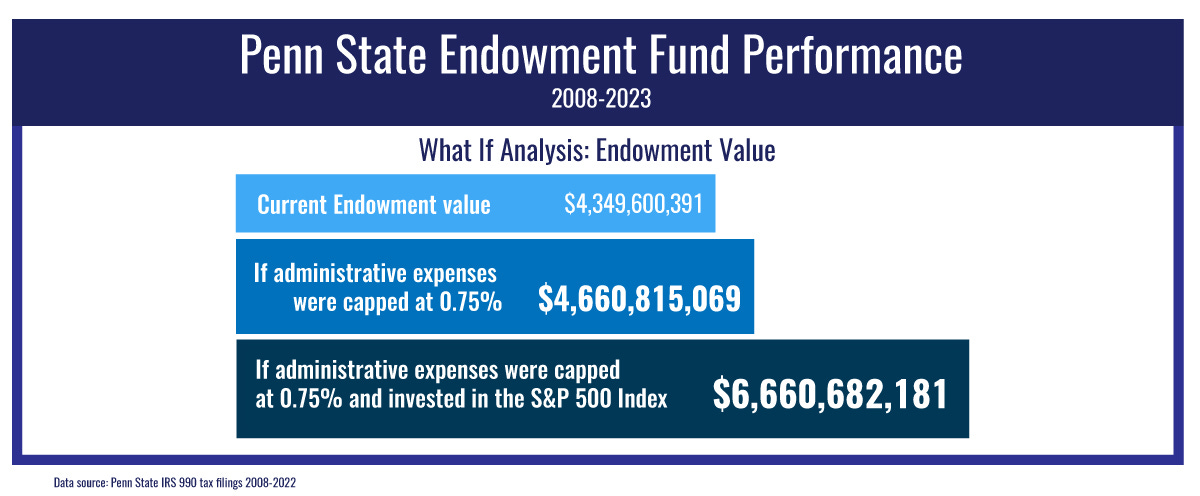

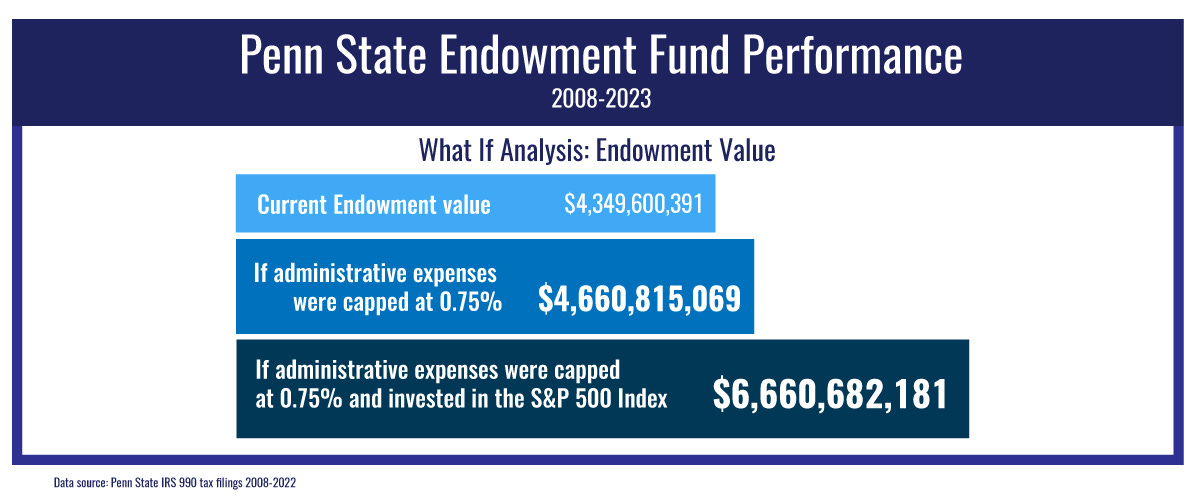

To test how well the PSIC is doing its job, I created two ‘what if’ scenarios to see if Penn State could have improved the endowment fund performance (see Note 3). The first scenario calculated ‘what if’ the PSIC had continued to hold the administrative expenses paid to 0.75% of the fund value? The second ‘what if’ asked if in addition to holding those expenses to 0.75%, ‘what if’ the investment managers simply invented the endowment in the S&P 500 Index?

The calculations show that if Penn State had continued capping the administrative expenses paid to 0.75%, the endowment value would be $4,660,815,069 or $311,214,678 richer.

If Penn State had held expenses to 0.75% and also invested in the S&P 500 Index, the endowment value would be $6,660,682,181 or $2,311,081,790 richer.

To put that difference into context: an additional $2.3 billion in the endowment would increase available distributions to fund a 10% reduction of in-state tuition, year-after-year, forever.

These issues merit, at the very least, a thorough and public deliberation. Instead, in my opinion we seem to be paying very high expenses for lackluster long-term investment management performance. This concerns me.

Note 1: When requested, information on the investment managers, their fee structure, and their performance has not been provided to me. Penn State’s Office of Budget and Finance aggregates this information to complete the required IRS Form 990, so it is available. I have asked why it is not available to trustees (who have ultimate responsibility for the Endowment) and have not been given a suitable explanation.

Note 2: You can find Penn State’s Form 990s under Right to Know Law Reports, Schedule D, Part V https://budgetandfinance.psu.edu/public-reports

Note 3: Link to my detailed spreadsheets: https://docs.google.com/spreadsheets/d/16rGBApfXOpu5mxq5rGXYKZ008Cya_7PQ_H-N57HtGyI/edit?usp=sharing